All Categories

Featured

Table of Contents

It's important to remember that SEC guidelines for recognized capitalists are designed to protect financiers. Without oversight from financial regulators, the SEC simply can't assess the threat and benefit of these investments, so they can not offer details to enlighten the typical capitalist.

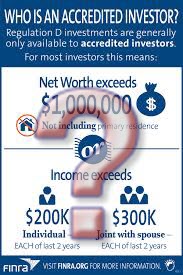

The idea is that investors who gain sufficient revenue or have adequate wide range are able to take in the risk better than investors with lower income or less wealth. accredited investor crowdfunding opportunities. As a certified financier, you are anticipated to complete your very own due persistance prior to adding any type of possession to your financial investment profile. As long as you meet one of the complying with four requirements, you certify as an accredited investor: You have made $200,000 or even more in gross earnings as a private, every year, for the previous two years

You and your spouse have had a combined gross earnings of $300,000 or more, each year, for the past two years. And you anticipate this degree of earnings to proceed. You have an internet worth of $1 million or more, leaving out the value of your primary residence. This suggests that all your assets minus all your financial debts (leaving out the home you stay in) overall over $1 million.

Accredited Investor Financial Growth Opportunities

Or all equity proprietors in the organization certify as recognized capitalists. Being a recognized investor opens up doors to investment possibilities that you can't access or else.

Becoming an accredited financier is simply a matter of showing that you fulfill the SEC's requirements. To validate your earnings, you can supply documents like: Tax return for the previous two years, Pay stubs for the past two years, or W2s for the previous two years. To verify your total assets, you can offer your account statements for all your possessions and liabilities, consisting of: Savings and inspecting accounts, Financial investment accounts, Outstanding car loans, And genuine estate holdings.

Favored Accredited Investor Financial Growth Opportunities

You can have your attorney or CPA draft a confirmation letter, validating that they have actually examined your financials which you meet the needs for a recognized capitalist. But it may be extra cost-effective to utilize a solution specifically designed to confirm certified investor standings, such as EarlyIQ or .

If you sign up with the real estate investment firm, Gatsby Investment, your accredited financier application will be refined with VerifyInvestor.com at no cost to you. The terms angel financiers, sophisticated financiers, and accredited capitalists are frequently utilized mutually, but there are subtle distinctions. Angel financiers provide venture capital for start-ups and small companies in exchange for ownership equity in the company.

Normally, anyone who is approved is assumed to be a sophisticated financier. Individuals and service entities who preserve high incomes or significant wealth are assumed to have practical expertise of money, qualifying as advanced. Yes, global financiers can come to be certified by American financial requirements. The income/net worth needs remain the exact same for international financiers.

Right here are the finest financial investment possibilities for certified capitalists in real estate.

Favored Accredited Investor Secured Investment Opportunities

Some crowdfunded realty investments do not require certification, yet the projects with the biggest potential rewards are usually booked for accredited financiers. The difference between projects that accept non-accredited financiers and those that only accept accredited investors normally comes down to the minimal investment amount. The SEC currently limits non-accredited investors, that make much less than $107,000 per year) to $2,200 (or 5% of your yearly income or total assets, whichever is less, if that quantity is even more than $2,200) of financial investment funding each year.

It is extremely similar to genuine estate crowdfunding; the procedure is basically the same, and it comes with all the very same advantages as crowdfunding. Real estate submission provides a stable LLC or Statutory Depend on possession design, with all financiers offering as members of the entity that possesses the underlying real estate, and a distribute that facilitates the task.

a company that buys income-generating property and shares the rental revenue from the residential properties with investors in the type of returns. REITs can be openly traded, in which instance they are regulated and offered to non-accredited capitalists. Or they can be personal, in which instance you would certainly need to be approved to spend.

Investment Platforms For Accredited Investors

Administration charges for an exclusive REIT can be 1-2% of your total equity each year Purchase costs for new acquisitions can come to 1-2% of the purchase rate. And you may have performance-based charges of 20-30% of the personal fund's profits.

But, while REITs concentrate on tenant-occupied residential or commercial properties with steady rental revenue, exclusive equity property firms concentrate on actual estate growth. These firms usually establish a story of raw land into an income-generating property like an apartment complex or retail buying. As with exclusive REITs, financiers in private equity ventures usually require to be accredited.

The SEC's meaning of accredited capitalists is created to recognize individuals and entities considered economically advanced and with the ability of assessing and getting involved in particular kinds of private financial investments that may not be available to the general public. Importance of Accredited Financier Condition: Verdict: To conclude, being a recognized investor lugs considerable significance worldwide of money and investments.

Comprehensive Accredited Investor Passive Income Programs

By fulfilling the criteria for accredited financier condition, individuals show their monetary sophistication and access to a world of investment possibilities that have the possible to produce considerable returns and contribute to lasting economic success (accredited investor property investment deals). Whether it's purchasing start-ups, property ventures, exclusive equity funds, or other alternative assets, recognized financiers have the advantage of checking out a varied variety of financial investment alternatives and developing wealth on their very own terms

Recognized capitalists include high-net-worth individuals, financial institutions, insurance coverage firms, brokers, and trusts. Recognized investors are defined by the SEC as qualified to spend in facility or innovative kinds of securities that are not very closely controlled. Certain requirements need to be fulfilled, such as having an average yearly revenue over $200,000 ($300,000 with a partner or domestic partner) or working in the economic industry.

Non listed safeties are naturally riskier because they lack the typical disclosure needs that come with SEC enrollment. Investopedia/ Katie Kerpel Accredited capitalists have privileged access to pre-IPO business, financial backing firms, hedge funds, angel financial investments, and various deals involving complex and higher-risk investments and instruments. A business that is seeking to raise a round of financing may determine to straight approach accredited financiers.

Table of Contents

Latest Posts

Tax Sale Housing

Government Tax Foreclosure Sales

Tax Foreclosed Property

More

Latest Posts

Tax Sale Housing

Government Tax Foreclosure Sales

Tax Foreclosed Property